Introduction:

In today’s data-driven world, Industries across the board are leveraging the power of Data Analytics to gain valuable insights and make informed decisions. The Real Estate industry is no exception. In this blog, we will explore how Data Analytics is revolutionizing how Real Estate businesses operate, and how it can be applied to improve lease management processes. Through the example of a Real Estate Lease Management Dashboard, we will showcase the practical application of data analytics in the real estate industry.

Understanding the Importance of Data Analytics in Real Estate

1. Enhanced Decision-Making:

- Data analytics provides real estate professionals with the ability to analyze vast amounts of data quickly and accurately.

- It enables them to make data-driven decisions based on market trends, property values, rental rates, and other crucial factors.

- With access to historical data and predictive modeling, professionals can identify investment opportunities and mitigate risks.

2. Optimized Property Valuation:

- Data analytics helps determine property valuations by considering various factors such as location, amenities, market demand, and comparable properties.

- By analyzing historical sales data, professionals can accurately estimate the value of a property, enabling better pricing strategies.

3. Market Demand and Trend Analysis:

- Data analytics tools can track market trends, buyer preferences, and demographic information.

- Real estate professionals can identify target markets and tailor their marketing strategies accordingly.

- By analyzing demand patterns, professionals can anticipate market shifts and adjust their inventory accordingly.

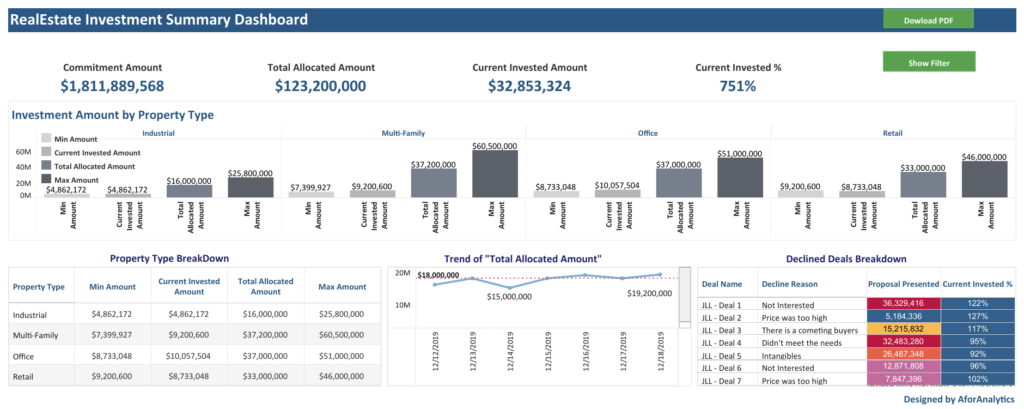

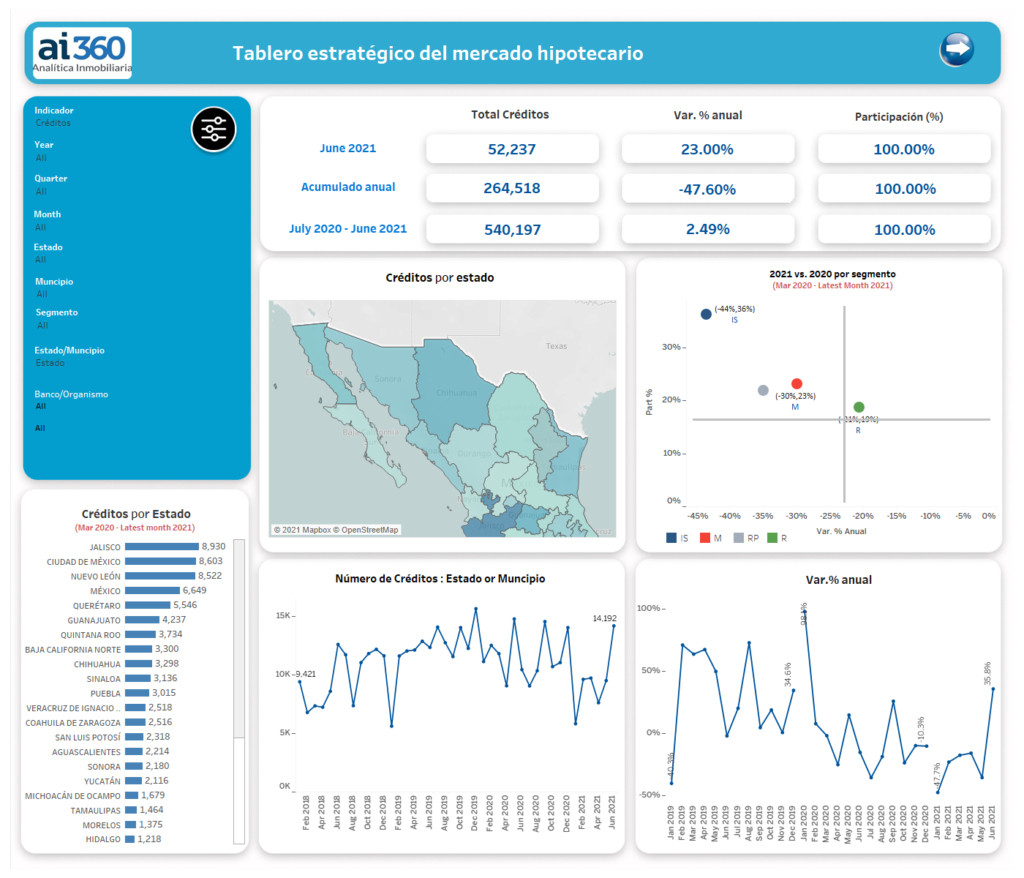

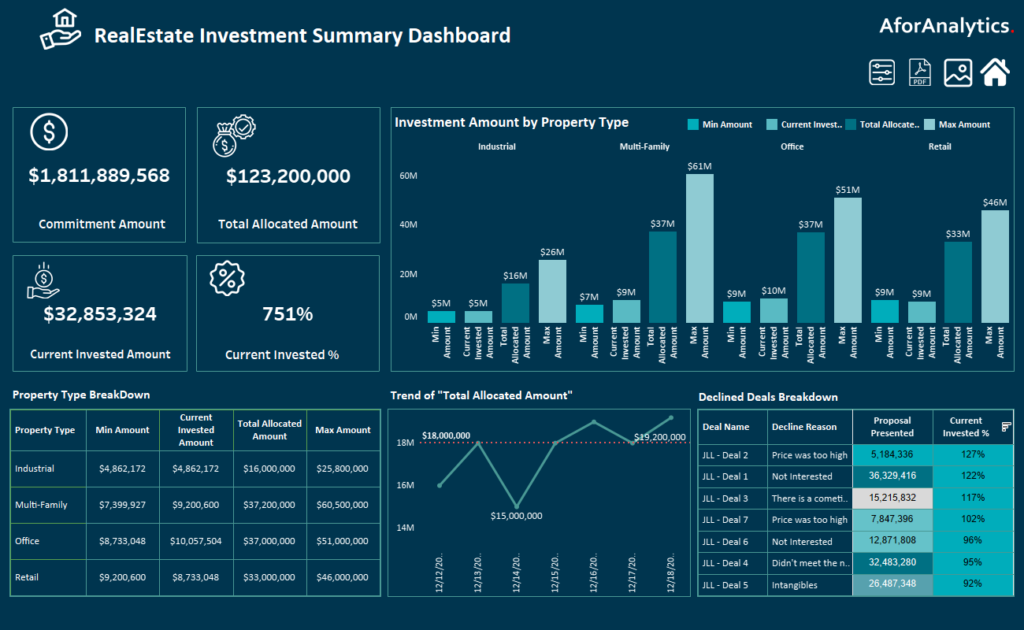

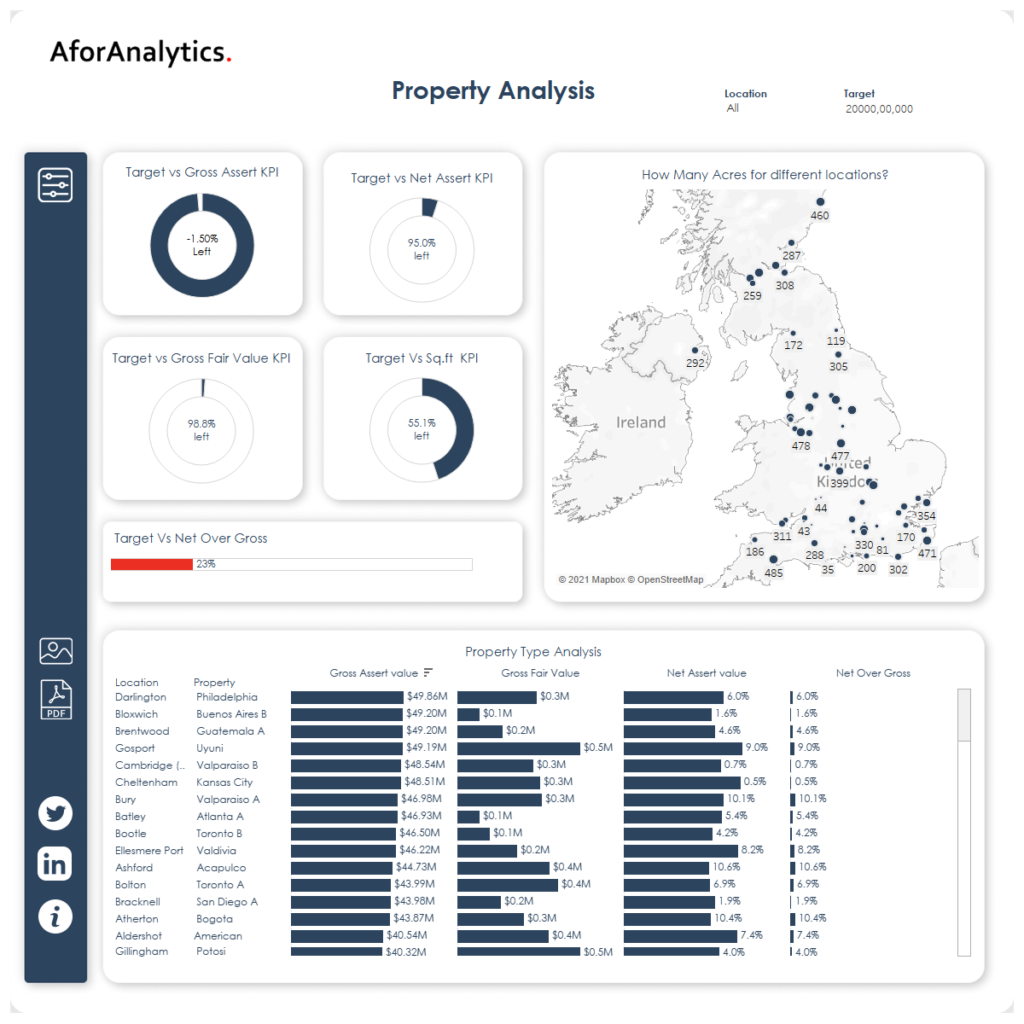

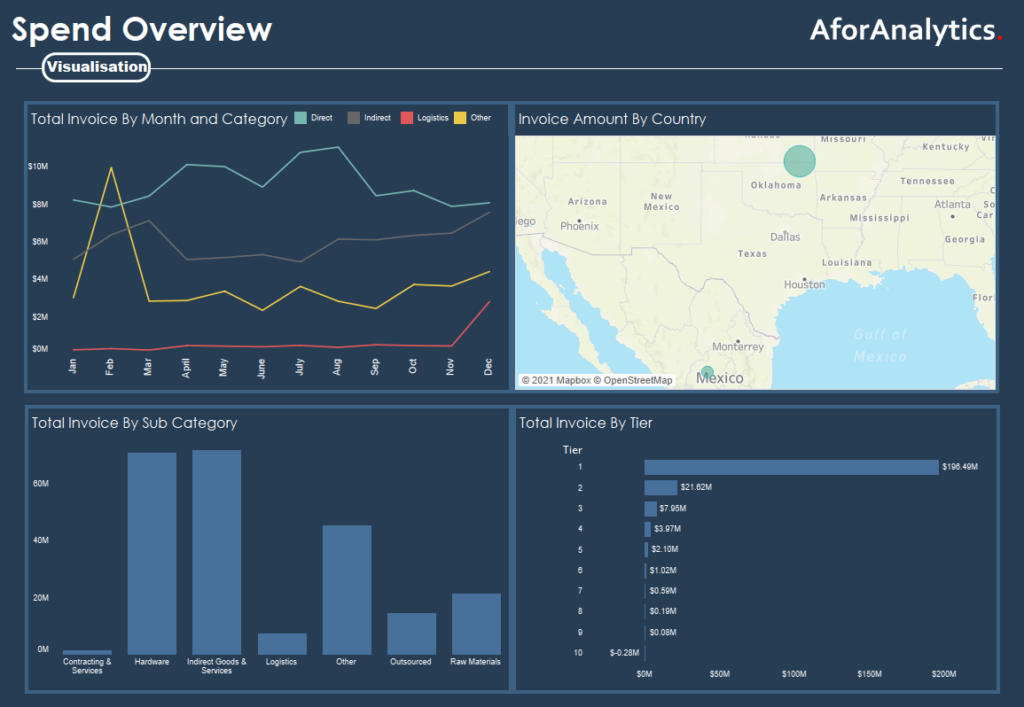

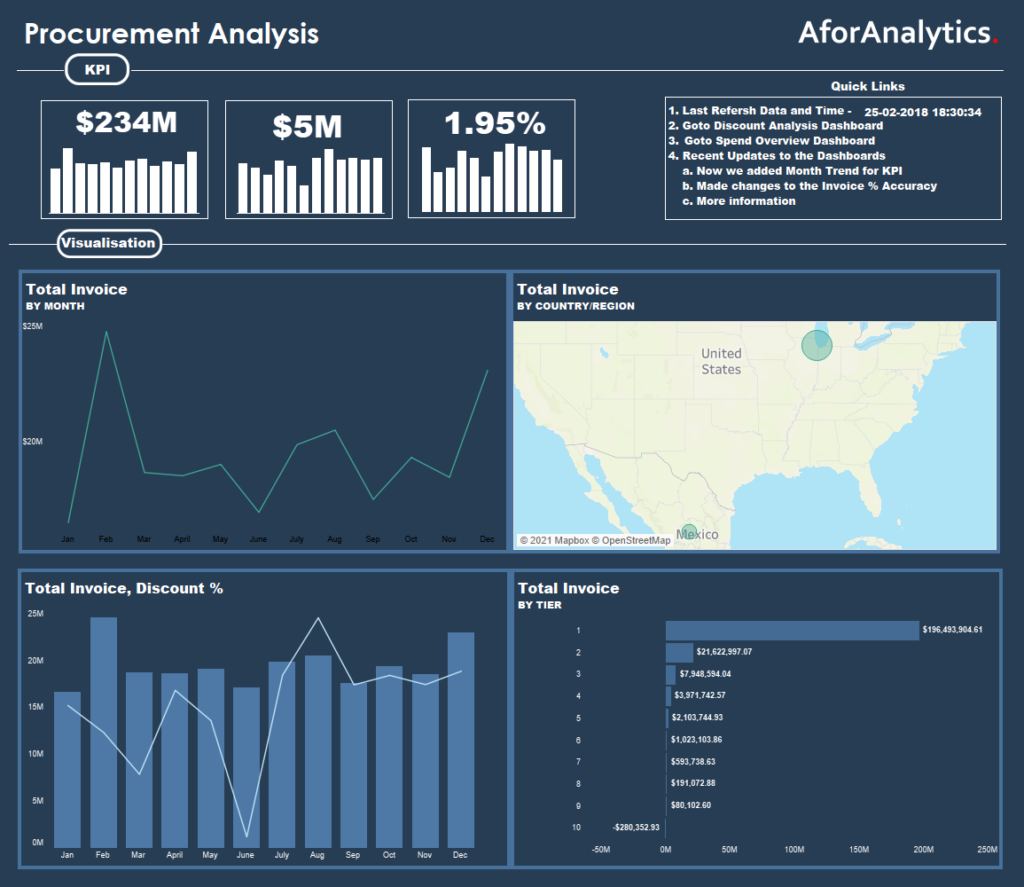

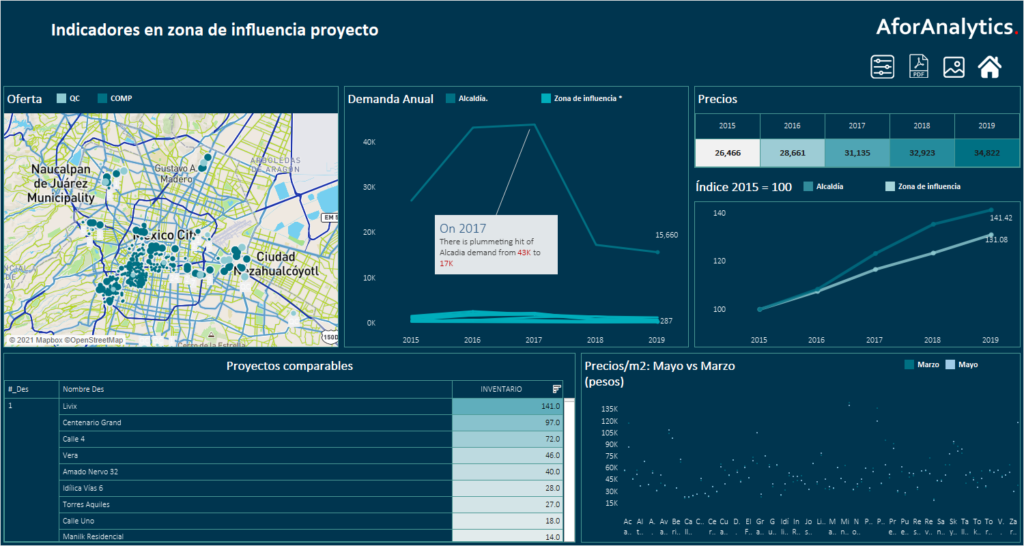

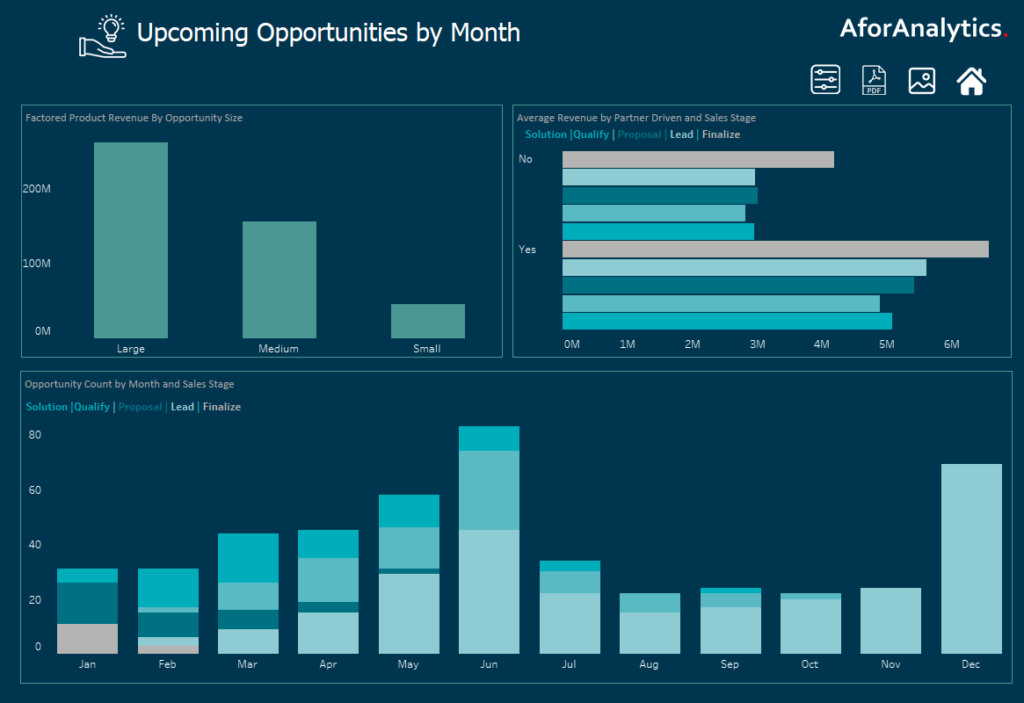

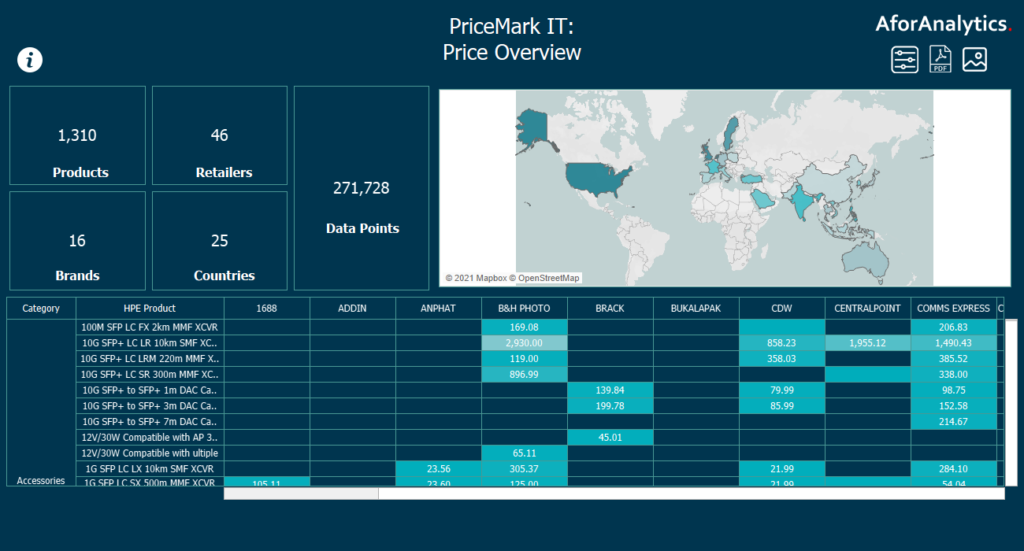

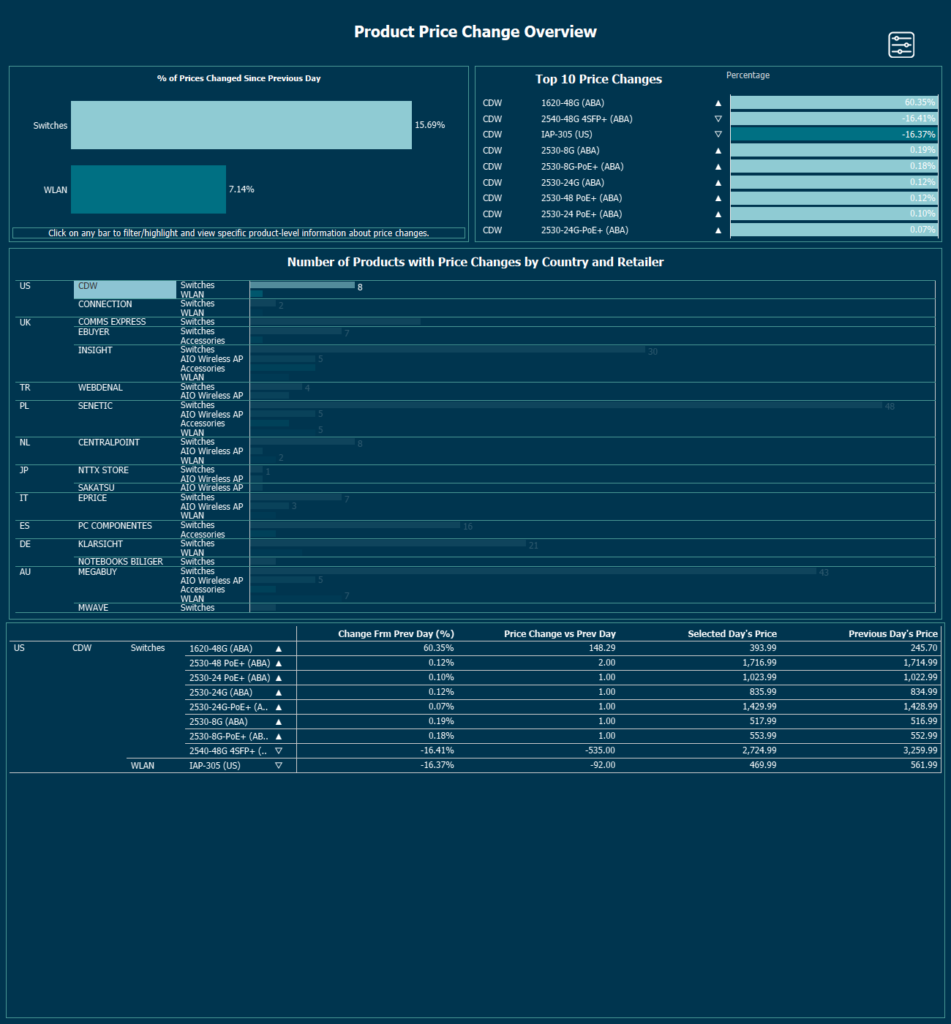

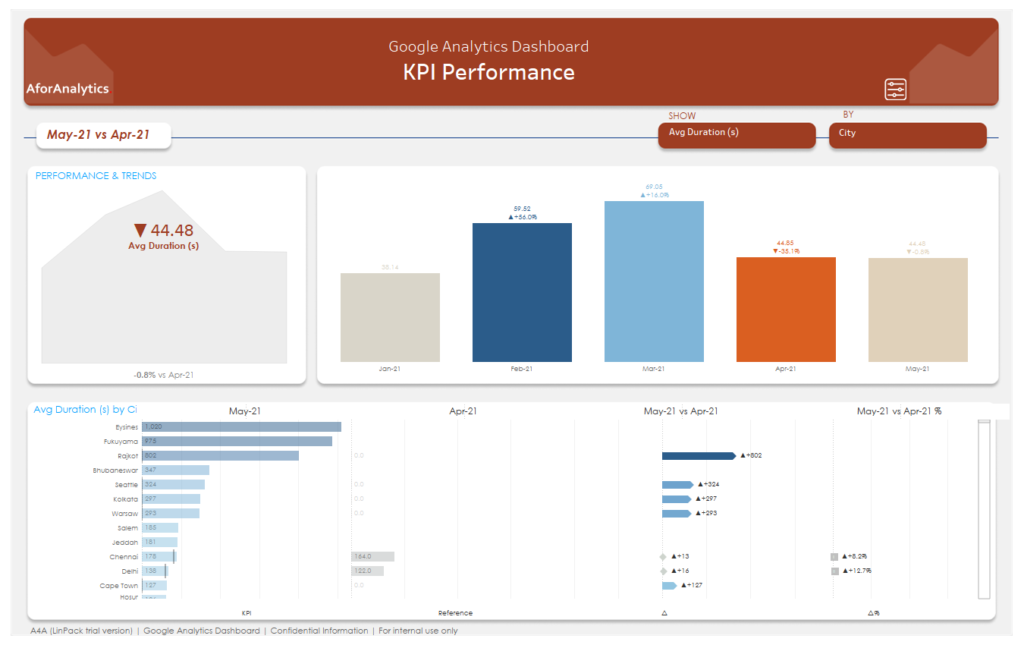

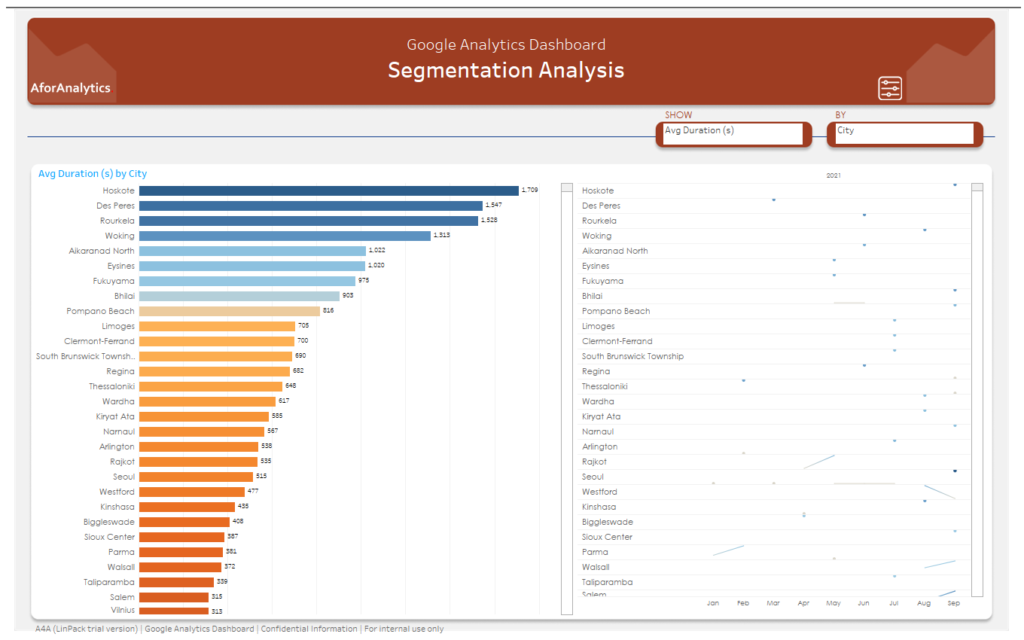

Real Estate Investment Dashboard: A Case Study

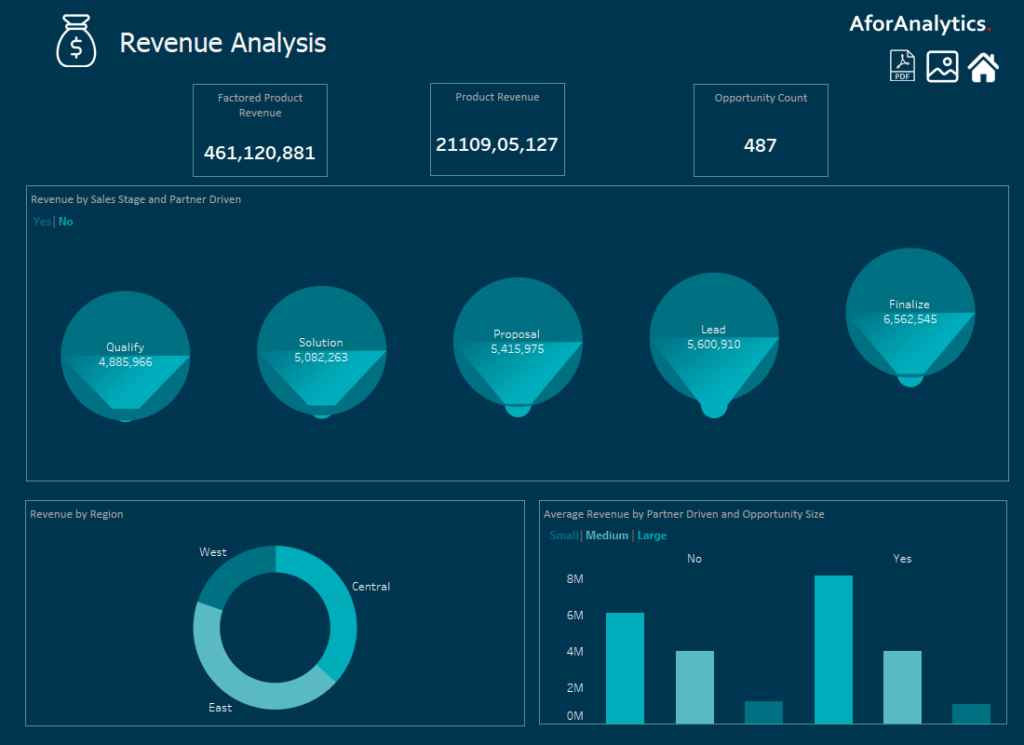

Real Estate Investment Dashboard provides real-time insights into key performance indicators for real estate investments, including property values, rental income, and occupancy rates, enabling investors to make data-driven investment decisions.

1. Property Portfolio Analysis:

- The dashboard consolidates information on multiple real estate investments, providing a comprehensive overview of the portfolio’s performance.

- Investors can analyze property values, rental income, and occupancy rates to assess the profitability and growth potential of their investments.

- By comparing the performance of different properties, investors can identify underperforming assets and take corrective actions.

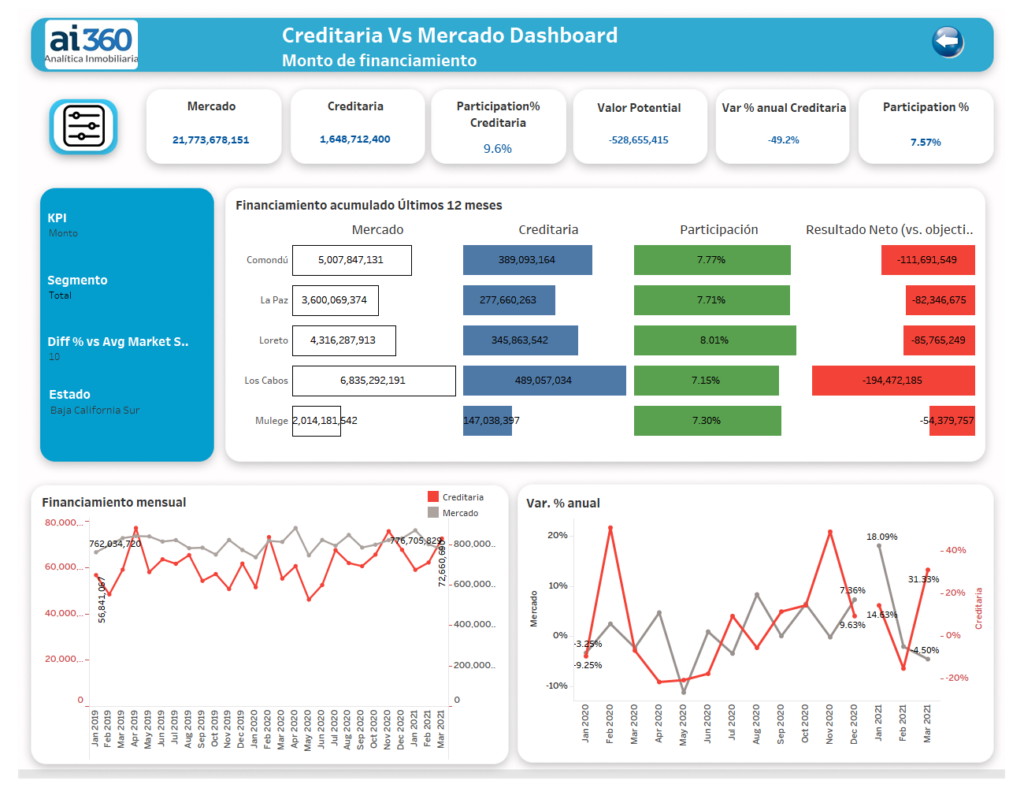

2. Market Insights and Benchmarking:

- The dashboard leverages market data and analytics to provide insights into market trends, rental rates, and property appreciation.

- Investors can benchmark their properties against the market, enabling them to identify areas for improvement and optimize rental strategies.

- By monitoring market trends, investors can make informed decisions regarding property acquisition, disposition, and portfolio diversification.

3. Risk Assessment and Mitigation:

- The dashboard incorporates risk analysis tools to evaluate investment risks, such as market volatility, tenant turnover, and property maintenance costs.

- Investors can identify potential risks and develop risk mitigation strategies to safeguard their investments.

- Real-time monitoring of key performance indicators enables investors to proactively address emerging risks and seize opportunities.

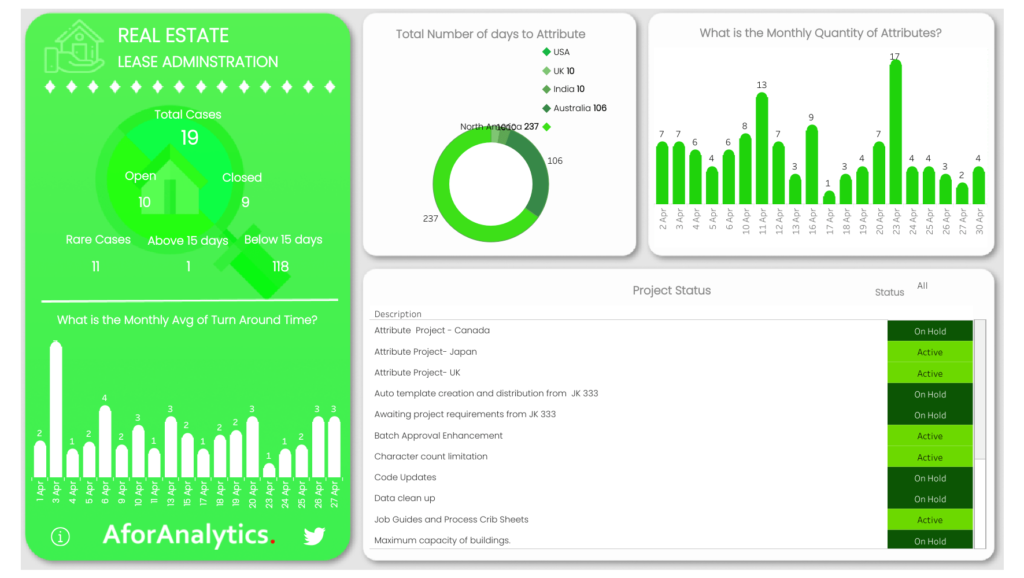

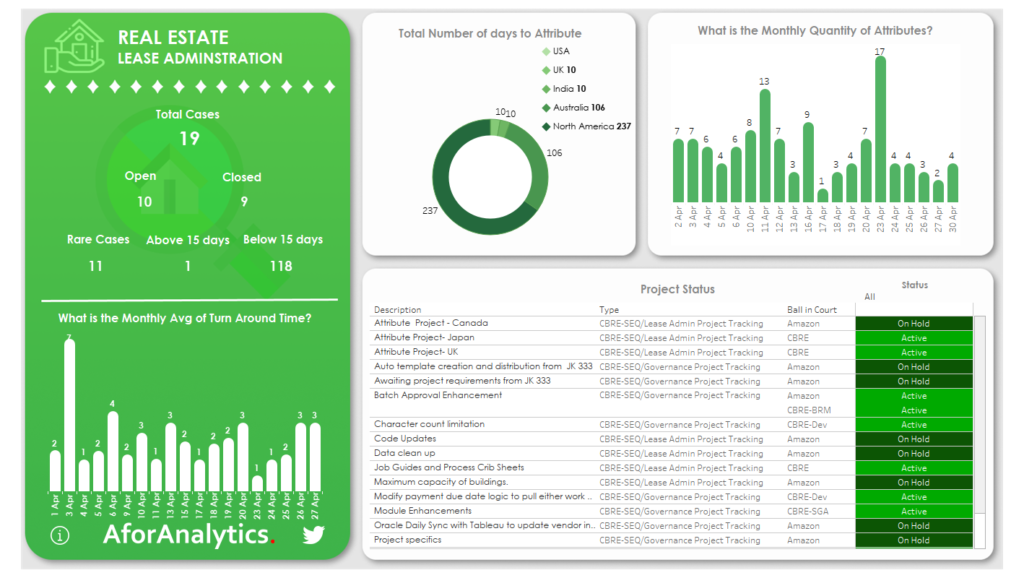

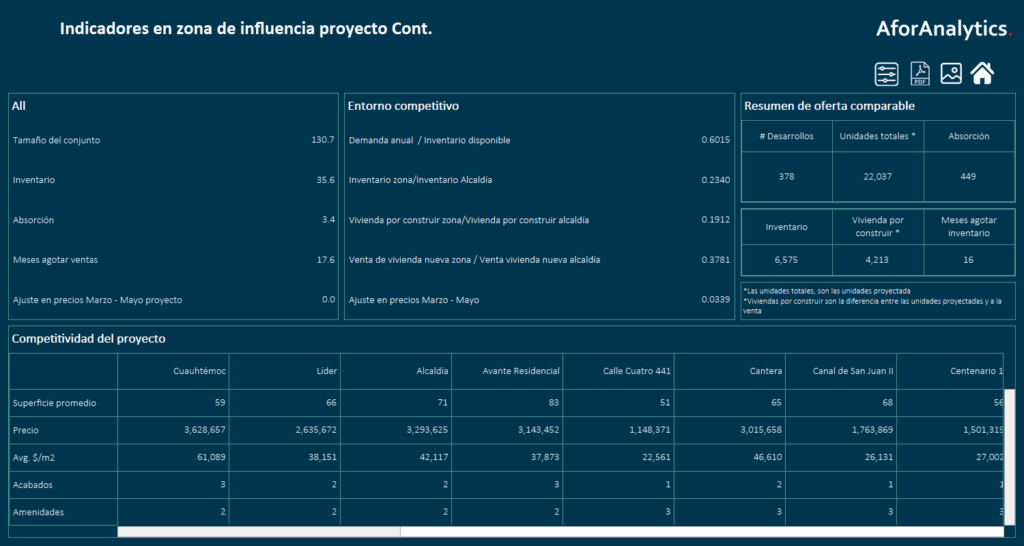

Real Estate - Lease Management Dashboard: A Case Study

Real Estate – Lease Management Dashboard provides a centralized platform for managing lease agreements, tracking rent payments and arrears, and monitoring lease expirations and renewals, enabling real estate managers to optimize lease management processes and maximize revenue.

1. Lease Agreement Management:

- The dashboard consolidates lease agreement information, including terms, conditions, and tenant details, in one place.

- Real estate professionals can quickly access and update lease information, reducing manual paperwork and streamlining processes.

- Automation features can trigger alerts for rent increases, lease renewals, or terminations, ensuring timely actions are taken.

2. Rent Payment and Arrears Tracking:

- The dashboard tracks rent payments and arrears, providing a comprehensive overview of financial performance.

- Real-time data analysis allows professionals to identify delinquent tenants and take appropriate measures to minimize revenue loss.

- Key metrics, such as rental collection efficiency, can be monitored, enabling quick identification of potential issues.

3. Lease Expirations and Renewals:

- The dashboard alerts real estate professionals about upcoming lease expirations, enabling proactive engagement with tenants for renewal negotiations.

- By analyzing historical lease data and tenant behavior, professionals can optimize renewal terms and increase tenant retention.

- Data-driven insights aid in predicting future leasing patterns and forecasting revenue streams.

The Benefits of Data Analytics in Real Estate

1. Improved Operational Efficiency:

- By automating manual tasks and centralizing data, real estate businesses can significantly improve operational efficiency.

- Streamlined lease management processes reduce administrative burden and enhance productivity.

- Data analytics tools provide real-time insights, enabling swift decision-making and eliminating time-consuming manual analysis.

2. Enhanced Customer Experience:

- Data analytics helps real estate professionals understand tenant preferences and deliver personalized experiences.

- By leveraging data insights, professionals can address tenant concerns promptly and provide tailored solutions.

- Improved customer experience leads to higher tenant satisfaction, increased occupancy rates, and ultimately, higher returns on investment.

3. Accurate Financial Forecasting:

- Data analytics enables real estate businesses to accurately forecast rental income, expenses, and profitability.

- By analyzing historical data and market trends, professionals can make reliable financial projections.

- Accurate forecasting aids in budgeting, resource allocation, and strategic planning, maximizing profitability.

Conclusion:

Data analytics has become a game-changer in the real estate industry, transforming the way professionals operate and make decisions. By harnessing the power of data, real estate businesses can optimize lease management processes, enhance customer experience, and drive revenue growth. The Real Estate – Lease Management Dashboard case study illustrates how data analytics can centralize lease management, improve financial performance, and enable proactive decision-making. Embracing data analytics is no longer an option; real estate professionals need to stay competitive in today’s dynamic market. Start unlocking the potential of your real estate business with data analytics today!

UJR Technologies provides DevOps Consulting Services in Hyderabad KPHB with best price.that promotes your business growth and increases sales revenue with development and operations.

useful information thank you for your post.